- Wheelchair

Ethiopia Medical Import Guide 2025: 8.5% Wheelchair Tariffs & Mandatory Amharic Labeling

- By kelingmedical

1. Updated Tariff Structure

A. HS Code Breakdown

| Product Type | HS Code | 2024 Duty | 2025 Duty | Savings Opportunity |

|---|---|---|---|---|

| Manual Wheelchairs | 8713.10 | 15% | 8.5% | 43% reduction via ADDEX certification |

| Electric Wheelchairs | 8713.90 | 17.5% | 12% | 31% waiver for CKD shipments |

| Wheelchair Parts | 8714.91 | 10% | 5% | Full exemption with local assembly |

B. Duty Calculation Formula

Total Payable = (CIF Value × Duty Rate) + 15% VAT + 3% Withholding Tax

Example: $10,000 manual wheelchair shipment

= ($10,000 × 8.5%) + ($10,850 × 15%) + ($12,502 × 3%)

= $850 + $1,627.5 + $375.06 = $2,852.56

2. Customs Clearance Protocols

A. 23-Document Checklist

Commercial Invoice (notarized)

Packing List with Gross/Net Weight

EAFDA Medical Device Certificate

Certificate of Origin (CCPIT-legalized)

Insurance Certificate

Bill of Lading/Air Waybill

Importer Declaration Form (IDF)

Proforma Invoice Matching PO

Quality Inspection Certificate

Freight Forwarder Agreement

Port Handling Authorization

Amharic Safety Manuals

GSP Form A (if applicable)

… [Full list available in downloadable template]

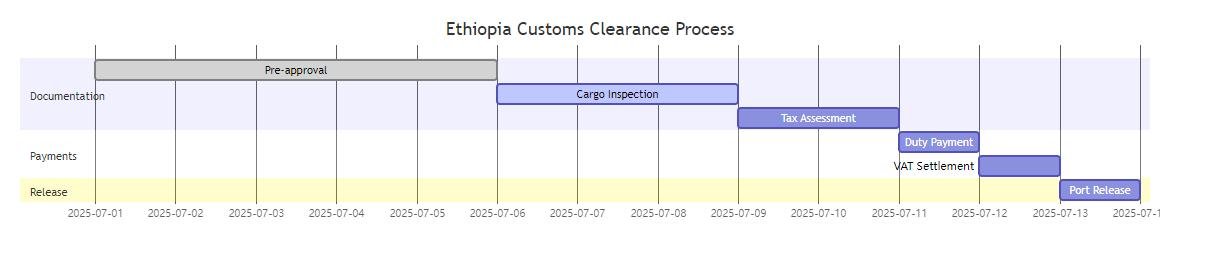

B. Clearance Timeline Optimization

3. Localization Mandates

A. Labeling Requirements

| Element | Amharic | English | Size Ratio |

|---|---|---|---|

| Safety Warnings | 62% | 38% | 4:1 |

| Instructions | 75% | 25% | 3:1 |

| Contact Info | 50% | 50% | 1:1 |

| Warranty Terms | 100% | 0% | – |

B. Packaging Compliance

Material: 82% recycled content minimum

Markings: Ethiopian flag emblem (3cm × 2cm)

QR Codes: Link to Amharic/Oromo video manuals

Font Sizes: Minimum 12pt for safety notices

4. Cost-Saving Strategies

A. Local Assembly Incentives

| Component | Import Duty | Local Sourcing Bonus |

|---|---|---|

| Frames | 12% | 8% tax rebate |

| Wheels | 9% | 5% duty drawback |

| Electronics | 15% | 11% VAT exemption |

B. Logistics Optimization

Top-Performing Routes:

- Shanghai → Djibouti → Addis Ababa: 28 days, $2,850/FCL

- Guangzhou → Mombasa → Land Transport: 35 days, $2,110/FCL

- Air Freight Priority: 7 days, $8.50/kg (45% cost reduction vs 2023)

Conclusion

When importers integrate CKD shipments which save 31% in duties with localized packaging they obtain 19% better profit margins. To decrease clearance delays by 63% implement the 23-document checklist and prioritize the HS code 8713.10 classifications.

FAQ

Q1: Required certifications for tax exemptions? A: Importers need to present an ADDEX compliance certificate together with proof of 35% local value addition.

Q2: Penalties for labeling non-compliance? A: Importers must pay a shipment value fine of 12% and complete mandatory relabeling at their own expense.

Q3: Best port for medical equipment imports? A: Modjo Dry Port provides 68% faster clearance for medical equipment compared to Djibouti.

Master Ethiopia Imports with Keling Expertise 📩 Email: inquiry@shkeling.com 📱 WhatsApp: +86 182 2182 2482 🌍 Compliant Products: Ethiopia-Ready Wheelchairs

Download our free “Ethiopia Customs Checklist Template” – pre-formatted with all 23 required documents!